Wells Fargo customers to receive $50 million for overcharged mortgage fees

Class action settlement moves forward By Ben Lane Borrowers who had a mortgage serviced by Wells Fargo between May 6, 2005 and July 1, 2010 could soon receive their share of a $50 million settlement, which stemmed from charges that Wells Fargo overcharged borrowers...

Trump Treasury pick: Fannie Mae and Freddie Mac will be privatized

Steve Mnuchin tells Fox Business: "We’ll get it done reasonably fast" By Ben Lane After President-elect Donald Trump announced that he selected Steve Mnuchin, a former executive at Goldman Sachs and former chairman of OneWest Bank, to lead the Department of the...

Donald Trump unveils plan to dismantle Dodd-Frank Act

"Bureaucratic red tape and Washington mandates are not the answer" By Ben Lane Now that the dust is starting to settle from the election, a clearer picture is beginning to emerge of what types of actions President-elect Donald Trump will pursue once the “-elect” is...

Wells Fargo to pay $50 million to settle claims of overcharging for appraisals

Accused of hiking up appraisal prices for struggling borrowers By Ben Lane It’s been a rough few weeks for Wells Fargo and things aren’t about to get any better. In the fallout from the bank’s fake account scandal, Wells Fargo lost its CEO, lost business from...

Ocwen facing CFPB investigation, potential fine for servicing practices

By Ben Lane It’s been nearly three years since Ocwen Financial agreed to offer $2 billion in consumer relief and pay up to $127.3 million to settle a Consumer Financial Protection Bureauinvestigation into its servicing practices. That settlement, and others with...

Washington hits Ocwen with fine for using unlicensed offshore companies

Ocwen to pay $900,000; only use licensed entities to service Washington loans By Ben Lane Ocwen Financial will pay $900,000 to the state of Washington after an investigation conducted by the state found that Ocwen used unlicensed companies in India and the Philippines...

Conservative groups join growing push to recapitalize Fannie Mae, Freddie Mac

Calls to end Third Amendment sweep now coming from all sides Over the last year, various groups, including community lenders, affordable housing advocates, civil rights groups, interested observers, and financial analysts, called for a change in governmental policy...

Compensation for Servicemembers Over Illegal Foreclosures Increased to $311 Million

By Brian Honea Another $186 million in compensation will be awarded to 1,461 service members and their co-borrowers over the unlawful foreclosure of their homes as part of the Department of Justice's settlement with five of the nation's largest mortgage servicers,...

House Committee Finds That Americans Are Less Free as a Result of Dodd-Frank

By Brian Honea On the 228th birthday of the U.S. Constitution on September 17, the House Financial Services Committee posed the question as to whether or not the Dodd-Frank Wall Street Reform Act of 2010 has provided the country with more or less freedom. The hearing,...

Non-Foreclosure Solutions Continue to Outpace Completions Five to One

By Brian Honea Non-foreclosure solutions continued to outpace completed foreclosures by a rate of approximately five to one in April while serious delinquencies continued their steady decline, according to data released on Wednesday by HOPE NOW, an industry-created...

For consumers seeking credit scores, VantageScores are no substitute for FICO scores

Here’s the truth By James Wehmann Consumers today are being bombarded by offers to get their “credit score” for free. These lead generation websites don’t provide the FICO Scores used by nearly all lenders – but some “experts” say that doesn’t matter. In fact, some...

CFPB fines TransUnion and Equifax for deceiving consumers with their marketing

Turns out it’s not only TransUnion By Brena Swanson The Consumer Financial Protection Bureau revealed in a press release on Tuesday that it is not only fining TransUnion but Equifax as well for deceiving consumers in marketing credit scores and credit products....

Homeowners: 4 tax deductions to maximize your IRS refund: It’s that time again

By Brena Swanson It’s tax season again. While you might not be jumping for joy at the thought of this, let’s at least make sure you’re doing your due diligence and gaining all the benefits you can from tax deductions that apply to you. And maybe when this is done,...

Legislation to Extend Tax Relief to Distressed Homeowners Currently in House, Senate Committees

By Brian Honea Two similar pieces of legislation introduced last month in the House and Senate that would extend tax relief to homeowners who are underwater on their mortgage loans have been referred to committees and are waiting to be heard. Congressman Tom Reed...

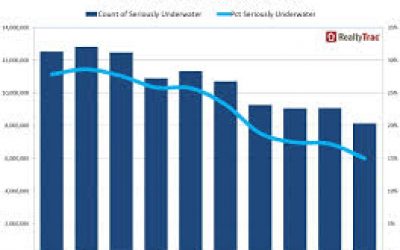

Negative Equity Falling, but Still Exceeds $1 trillion

By: Jann Swanson The percentage of American homeowners a mortgage that was seriously underwater fell to 15 percent in the third quarter of 2014 RealtyTrac said on Thursday. There were 8.1 million properties with mortgages that met the company's definition of...

Bankruptcy Fraud- Arrested, Charged with Bankruptcy Fraud

By Author: Brian Honea A Wisconsin man once known as the "king of foreclosures" and his adult son were arrested at their home Monday and charged with bank fraud and bankruptcy fraud. Todd Brunner, 57, and his son, Shawn, 24, were arrested in their Pewaukee,...

Trump Officially Taps Carson for HUD Secretary

By Brian Honea As initially reported by DS News, President-elect Donald Trump has been on-record that he favored Dr. Ben Carson as the next HUD Secretary. On Monday, CNN reported that this preference became official with Trump's transition team announcing the...

Strong FHA annual report stirs up calls for mortgage insurance premium cut

Mutual Mortgage Insurance Fund grows for 4th straight year By Ben Lane Earlier this year, some analysts predicted that the Federal Housing Administration would cut its mortgage insurance premiums, assuming that the FHA’s Mutual Mortgage Insurance Fund continued its...

How housing would fare under Clinton, Trump

By CNBC Real Estate Reporter Diana Olick For an election supposedly based on the economy, housing policy has been not just conspicuously but egregiously absent from the rhetoric. In order to gauge which candidate would favor the U.S. housing market, one has to look at...

Washington hits Ocwen with fine for using unlicensed offshore companies

Ocwen to pay $900,000; only use licensed entities to service Washington loans By Ben Lane Ocwen Financial will pay $900,000 to the state of Washington after an investigation conducted by the state found that Ocwen used unlicensed companies in India and the Philippines...

Compensation for Servicemembers Over Illegal Foreclosures Increased to $311 Million

By Brian Honea Another $186 million in compensation will be awarded to 1,461 service members and their co-borrowers over the unlawful foreclosure of their homes as part of the Department of Justice's settlement with five of the nation's largest mortgage servicers,...

Non-Foreclosure Solutions Continue to Outpace Completions Five to One

By Brian Honea Non-foreclosure solutions continued to outpace completed foreclosures by a rate of approximately five to one in April while serious delinquencies continued their steady decline, according to data released on Wednesday by HOPE NOW, an industry-created...

TransUnion: Student loans do not impact housing Student debt keeps growing but home buyers still buying

By Ben Lane Despite the level of student loan debt rising to well above $1 trillion, young buyers are not being inhibited from obtaining a mortgage due to their debt, according to a new report from TransUnion. According to the latest report from the Federal Reserve...

Ocwen, Assurant to pay $140 million to settle force-placed insurance suit: Class-action suit accused Ocwen of artificially inflating costs

By Ben Lane Ocwen Financial (OCN) and Assurant (AIZ) have agreed to pay $140 million to settle a massive class-action lawsuit, which accused Ocwen of artificially inflating the cost of force-placed insurance in exchange for kickbacks from Assurant. The settlement...

Green Tree $63 million for “mistreating borrowers”: Green Tree harassed and threatened overdue homeowners

By Ben Lane The Consumer Financial Protection Bureau and theFederal Trade Commission announced Tuesday that the organizations are taking action against Green Tree Servicing, a subsidiary of Walter Investment Management Corp. (WAC), for “mistreating borrowers” who were...

Fannie Mae: Slow Wage Growth Stalls Consumer Housing Sentiment

By Brian Honea The optimism expressed by consumers toward the economy and the housing market at the beginning of the year has stalled as consumers' attitudes toward personal finances and wage growth have taken a step backward, according to Fannie Mae'sMarch 2015...

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.